02 OCT 2025

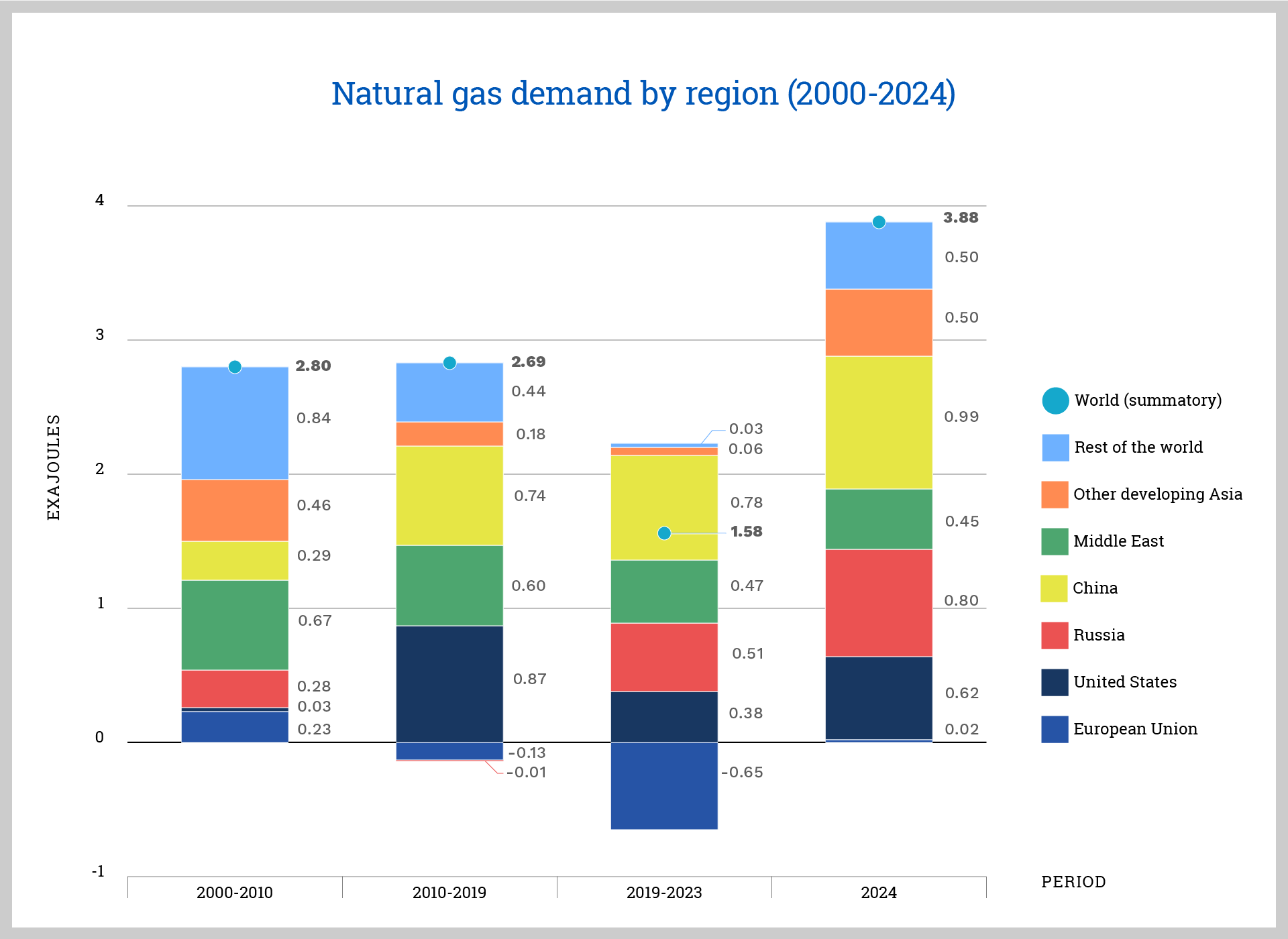

The global demand for natural gas is rising steadily. Natural gas — primarily methane — accounts for roughly 24% of global primary energy consumption and is often regarded as a transition fuel due to its cleaner combustion compared to coal or oil. It plays a key role in stabilizing energy systems based on intermittent renewables by providing dispatchable power. However, gas reserves are frequently located far from major markets and pipeline infrastructure. To bridge this gap, liquefied natural gas (LNG) has become essential.

Traditionally, LNG production has centered around massive export plants designed to achieve economies of scale. But over the last decade, small-scale LNG has emerged as a flexible, modular alternative that opens up new markets and monetizes resources that were previously uneconomic.

Small-scale LNG plants bring the benefits of liquefaction to gas sources that cannot justify a mega-plant or a pipeline. They enable companies to monetize small or remote gas fields, flare gas from oil wells, or serve “LNG islands” (customers beyond the grid). In contrast, large-scale LNG plants are tied to major transmission systems and always export large volumes by sea. Understanding the differences and applications of small- versus large-scale LNG is crucial for planning new projects and meeting modern energy needs.

What Is Small-Scale LNG?

“Small-scale LNG” generally refers to liquefaction facilities much smaller than conventional LNG terminals. There is no single universally accepted cutoff, but industry guidelines help. For example, the International Gas Union (IGU) suggests that small-scale liquefaction plants are those with a capacity under about 0.5 million tonnes per annum (MTPA). Similarly, IGU defines a small-scale regasification (receiving) terminal as under ~1 MTPA and small LNG vessels as under 60,000 m³ capacity. By comparison, many traditional LNG export plants produce 4–8 MTPA or more. (The world’s largest plants now exceed 10 MTPA.)

In practice, the term covers a range of concepts. Industry suppliers often use labels like “micro-LNG,” “mini-LNG,” or “medium-scale LNG,” but these typically refer to proprietary equipment and don’t have strict definitions. The key idea is that small-scale LNG projects use standardized or modular technology to serve modest demand. They may use a single “train” of liquefaction, often below 0.5 MTPA, and sometimes well under 0.1 MTPA per unit. For example, Galileo’s Cryobox™ liquefaction module (the size of a 40-foot container) can produce on the order of 10–20 tonnes per day (up to ~0.005–0.01 MTPA) and can be linked in parallel to scale up as needed.

Small-scale LNG is not a fundamentally different process – it still uses proven cryogenic refrigeration cycles to condense gas – but the plants are simpler, use fewer trains and no exotic refrigerants, and focus on cost‑effectiveness at smaller volumes. In essence, they bring large-plant performance into a compact, low‑CAPEX package with modular design.

Why Small-Scale LNG Matters

LNG is used whenever pipelines cannot reach or are uneconomical. Pipelines enjoy strong economies of scale: a very large-diameter line can carry far more gas for only a modest extra cost, so pipelines often make sense when there is a stable, high-volume market along the route. But pipelines also require a very high baseload (on the order of tens of millions of gigajoules (GJ) per year) and often long distances. Rule-of-thumb analyses suggest that below about 300–350 km, it is usually cheaper to build a transmission or distribution pipeline, whereas beyond ~300 km, LNG transport tends to be more economical. Similarly, pipeline costs scale linearly with distance, whereas LNG has a high fixed “threshold” cost (liquefaction/regasification) but only a modest marginal cost per km. Therefore, for small markets, remote facilities, or where demand is scattered, LNG can be the better choice.Today’s energy and environmental trends are driving demand for small-scale LNG:

- Remote or Isolated Gas Sources. Many gas fields — including associated gas from oil wells, biogas, or small reserves — are too remote or small to justify pipeline connection or a mega-LNG facility.

- Flaring Reduction. According to the World Bank, over 140 billion cubic meters of associated gas were flared globally in 2020. Small-scale LNG plants can capture this gas onsite, liquefy it, and transport it to market, offering both environmental and economic value.

- Transportation Fuels (Bunkering and Trucking). Emissions regulations and fuel costs are spurring a shift to gas for heavy transport. Small-scale LNG is already used for marine bunkering (fueling ships) and long-haul trucks. LNG burns cleaner than diesel, yielding significant reductions in NOₓ, SOₓ and CO₂ emissions.

- Industrial Uses. In addition to power generation, LNG can fuel industrial processes, steam generation, and heating at plants without pipeline gas. Factories are switching from diesel or LPG to LNG supplied by ISO containers or micro-stations. Mining operations in Australia have studied LNG delivery to remote sites as a diesel substitute.

- Niche End-Users (Peak Shaving & Off-Grid Power). Industries or communities that lie beyond the existing grid (sometimes called “LNG islands”) can be served by trucked or barged LNG. These include remote mines, factories, or islands. Small-scale LNG can also provide peak shaving: delivering extra fuel for power generation during high-demand periods when pipelines are full, or as backup power.

In short, small-scale LNG fills the gap between local gas and large LNG exports. It unlocks markets that large projects cannot reach economically, and helps companies comply with environmental regulations by avoiding flaring and reducing diesel use.

Transporting Gas: Pipelines vs. Small-Scale LNG

Transporting natural gas to markets and users can be done by pipeline, trucks (compressed CNG or LNG), or by ship. Each method has cost and logistical trade-offs. Pipelines are cheapest per unit over short to moderate distances and for very large flows, but they require enormous up-front investment and take years to build. Once built, pipelines can deliver gas continuously at modest operating cost. In contrast, LNG transport (liquefy, load on truck or ship, then regasify at destination) has a high fixed “threshold” cost (liquefaction and regasification), but relatively low incremental cost per km beyond that.

Analysts estimate that for a single customer requiring ~60,000 tonnes/year of gas, a pipeline might only be justifiable for 300–350 km. Beyond that, LNG or CNG becomes competitive. In practice, compressed natural gas (CNG) in tube trailers often wins out for distances under ~300 km, whereas LNG becomes more economical for longer hauls. Galileo’s experts note that as a rule of thumb, it is cost‑effective to truck CNG up to ~250 miles (~400 km), beyond which LNG (with higher energy density) is the better transport fuel.

In this context, small-scale LNG systems enable the creation of “virtual pipelines”: flexible, modular networks that replicate the function of a traditional pipeline using ISO-containers, cryogenic storage, and mobile regasification. Solutions like Galileo’s LNG Virtual Pipeline make it possible to move gas from source to consumer without the need for permanent infrastructure or long construction lead times. A typical configuration includes onsite liquefaction (e.g., Cryobox units), LNG storage, transport in ISO-containers (via road or rail), and satellite regasification stations or direct-use applications. This approach drastically shortens time-to-market, reduces capital exposure, and extends access to natural gas in regions that were previously off-grid.

Applications of Small-Scale LNG

Las plantas small-scale sirven para una variedad de casos de uso. Algunas de las principales aplicaciones incluyen:

Bunkering marino

GNL como combustible marino para ferrys, barcos portacontenedores y petroleros. Los puertos de todo el mundo están instalando infraestructura de bunkering para cumplir con los estándares de emisiones marítimas.

Transporte pesado

Las flotas de camiones de larga distancia están utilizando cada vez más el GNL como un combustible más limpio y estable en cuanto a costos. El GNL a pequeña escala permite cadenas de suministro regionales a través de estaciones e ISO-contenedores.

Generación de energía off-grid (fuera de la red)

Empresas de servicios públicos, minas y comunidades usan GNL para la generación de energía donde no existen gasoductos. Las unidades modulares de regasificación y los gensets (generadores) completan el sistema.

Soluciones de peak-shaving

Las terminales de GNL ayudan a satisfacer la demanda de gas estacionario o de emergencia en centros urbanos o industriales, inyectando gas a la red cuando la capacidad de los gasoductos es insuficiente.

Monetización del gas de flaring

Las plantas modulares licúan el gas asociado directamente en el pozo, evitando el flaring y permitiendo su transporte y uso como combustible o materia prima.

Suministro energético industrial

El GNL a pequeña escala sirve a las industrias que requieren calor de proceso o gas como insumo sin conexión a gasoductos, mejorando la seguridad energética y el perfil de emisiones.

Key Differences Between Small-Scale and Large-Scale LNG

Although the end product (LNG) is the same, small-scale and large-scale LNG facilities differ in many important ways:

|

Attribute |

Large-Scale LNG |

Small-Scale LNG |

|

Scale |

>10 MTPA total |

<0.5 MTPA per train |

|

CapEx |

$10+ billion |

Tens to hundreds of millions |

|

Build Time |

4–6 years |

<18 months |

|

Logistics |

Pipelines + LNG carriers |

Trucks, rail, ISO tanks |

|

Users |

Utilities, nations |

Industries, transport, remote power |

|

Technology |

Complex refrigerant cycles |

Simpler modular designs |

|

Financing |

20-year SPAs, sovereign backing |

Shorter contracts, private equity possible |

|

Risk |

High CapEx, long lead time |

Lower exposure, faster ROI |

- Scale and Capacity. Large-scale LNG plants have capacities in the millions of tonnes per year (MTPA). By contrast, small-scale plants may have a single train producing a few thousand to a few hundred thousand tonnes per year. Some are literally transportable modules.

- Applications and Value Chain. Large LNG plants are usually located at coastal export terminals or near major gas basins, and are integrated with high-pressure pipelines. The value chain is long (extraction, pipeline transport, liquefaction, shipping, regasification, and distribution). Small-scale facilities, by contrast, have a shorter value chain. In practice, small-scale projects serve much more localized or specific markets (isolated fields, LNG-fueled fleets, local power plants) compared to large-scale projects.

- Infrastructure and Logistics. Large-scale LNG requires extensive infrastructure: massive cryogenic tanks, high-capacity compressors, marine terminals, and pipelines — often covering over 300,000 m². In contrast, small-scale LNG fits into 10,000–20,000 m² using modular, factory-built equipment. While large plants ship by sea in costly carriers, SSLNG moves via road tankers, ISO containers, or even barges. This logistical flexibility allows access to inland or remote users, not just coastal ports.

- Capital Cost and Financing. Mega-LNG projects can exceed $10 billion and require long-term, 20–25 year SPAs for financing. Small-scale projects, with costs in the hundreds of millions or less, are more financially agile. They can scale modularly and rely on shorter-term contracts (5–10 years). Prefabricated components reduce construction time, cost, and risk. For example, Galileo reports its Cryobox™ units cut CAPEX by up to 50% compared to conventional mini-LNG designs.

- Construction Time and Workforce. Large LNG terminals can take 4–6 years to build and require up to 10,000 workers, often in remote areas. A standardized small-scale plant can be built and commissioned much faster – often in 18 months or less. For example, a modular Cryobox unit only needs a concrete pad and basic utilities to start up. Shorter construction means lower labor costs and less exposure to delays.

- Technology Complexity. Large plants use complex mixed-refrigerant cycles with dozens of process units. Smaller plants favor simpler technologies — like expander or single mixed-refrigerant cycles — which reduce cost and increase reliability. Galileo’s Cryobox, for example, uses a multistage cycle with boil-off recovery, delivering >99% uptime even in remote settings.

- Safety and Footprint. While both plant types follow strict safety standards, large-scale LNG involves greater risk due to its large inventories. Small plants handle much smaller volumes, requiring less safety buffer. As a result, small-scale facilities can often be built closer to populated or industrial areas, with standard equipment and reduced exclusion zones.

Advantages of Small-Scale LNG

Small-scale LNG projects offer several strategic and economic advantages:

- Lower Financial Risk. With smaller upfront investment and the ability to sign shorter contracts, small-scale LNG lowers financial exposure.

- Scalability. Small LNG plants are inherently modular. If demand grows, operators can add parallel liquefaction “trains”. For instance, each Cryobox module can be deployed incrementally, so a company can grow at the pace of demand without overbuilding.

- Flexibility. Small-scale plants can be deployed at various points in the gas value chain — from wellhead to end-user. They handle different gas qualities (including biogas and flare gas) and can switch between LNG and CNG.

- Environmental Benefits. Small-scale LNG helps reduce flaring and enables more users to switch from diesel or coal to cleaner natural gas. It lowers local pollutants and greenhouse gases, with the added benefit of minimizing methane leaks.

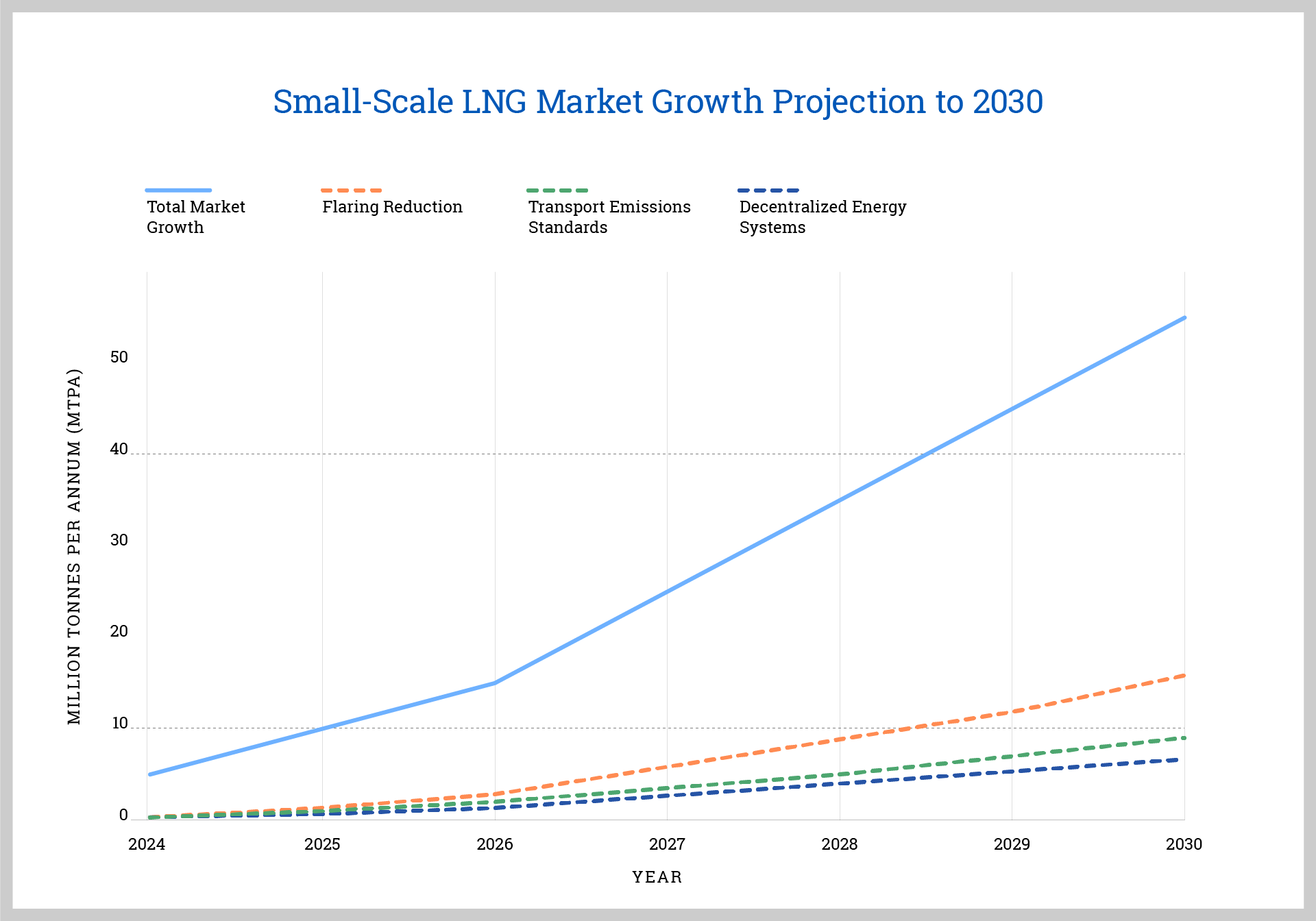

Market Trends and Outlook

The small-scale LNG market is expanding rapidly. Forecasts suggest it could reach 80–100 million tonnes annually by 2030, driven by:

- Global flaring reduction initiatives

- Stricter transport emission standards

- Decentralized energy systems

- Demand for cleaner industrial fuels

Major players like Shell, Engie, ENI, Gazprom, and Pertamina are investing in bunkering stations, trucking infrastructure, and small-scale liquefaction. Low gas prices, modular technology, and faster deployment give Small-scale LNG a strategic edge in an evolving energy landscape.

Conclusion: Complementary Roles in a Diversified Gas Future

Small-scale LNG is not replacing large-scale LNG, but rather complementing it. Big LNG projects will continue to serve the bulk, long-distance trade of gas. Meanwhile, small-scale LNG is carving out new markets by connecting stranded or dispersed gas supplies to customers. By being modular, faster to build, and adaptable, small-scale LNG plants open up opportunities in marine bunkering, heavy transport, remote power, and emissions reduction. They help utilities and industries comply with environmental goals, and they offer a hedge against the high capital and long lead times of mega-projects.

As natural gas continues to support the energy transition, modular, fast-to-market solutions like small-scale LNG will play a crucial role in extending access to cleaner fuels.

Fuentes:

- International Gas Union (IGU) — Guidelines and definitions for small-scale LNG.

- OwnerTeamConsult — Comparative analysis of small-scale and large-scale LNG.

- BER Consulting — Applications and business models for small-scale LNG.

- Strategy& (PwC) — Report on the growth and potential of small-scale LNG.

- TotalEnergies — Use of LNG in mobility and decentralized energy systems.

- Orlen Group — Implementation of small-scale LNG infrastructure in Europe.

- Texas for Natural Gas — Information on the environmental and economic benefits of natural gas.

- EDF (Environmental Defense Fund) — Impact of methane emissions and natural gas.

- IPIECA — Sustainability in the oil and gas sector, including small-scale LNG perspectives.

- International Aluminium Institute (IAI) — Industrial use of gas for process heat and decarbonization.

- APEC Energy Working Group — Research on LNG and gas policies in the Asia-Pacific region.

- The Electricity Hub — The role of LNG in providing energy to off-grid communities.

- PR Newswire — Press releases and case studies on LNG implementations.